Ads

It's happened to all of us. The end of the month arrives and we don't understand where the money went.

There were no big purchases. No luxuries. Just small expenses that, in the end, added up to more than we imagined. Apps that transform your wallet.

Ads

Maybe you've felt it. That feeling of losing control. Of not knowing exactly where the money went this time. You planned for it, yes. But the unexpected happened. A forgotten subscription. An unnecessary expense. The coffee you bought every day without realizing it.

And suddenly, the budget was gone. Anxiety set in.

Ads

What many don't know is that this story can change. That you can regain control without stress. Without complicated formulas. Just with a little organization and a good ally in your pocket.

Today I'll tell you how. And I'll introduce you to two apps that surprised me with how easy, useful, and powerful they are. If you've ever wanted to master your finances, now's the time.

And that's where the question that's been going around in our heads appears:

How can I have more control over my finances without going crazy?

The good news is that you don't need to be an accountant or even use an Excel spreadsheet.

Today, with just a few taps on your phone, you can have a clear, organized, and useful view of all your money.

And I'm not talking about empty promises. I'm talking about two apps I tried, explored, and kept. really surprised with the efficiency of the.

If you are ready to take over or control your financial life, these are the tools for you. Apps that transform your pocket.

See also

- Apps to combat stress and anxiety.

- Discover the symphony of nature

- Master communication with 3 apps.

- Free up space and optimize your phone!

- Immerse yourself in terror anywhere.

Why is it so difficult to control expenses?

Because we weren't taught how to do it.

And because we live surrounded by incentives to spend.

Because everything is immediate. And recording every purchase seems unnecessary… until we feel the bag empty.

The problem isn't spending. The problem is spending without knowing.

When we don't see where the money goes, we live with anxiety.

But when we begin to see clearly, everything changes. The power comes back to us.

What a good app can do for you

A personal finance app is not a calculator.

It's a smart tool. Made to give you something we all need: visibility.

With a good app you can:

- Record expenses in seconds

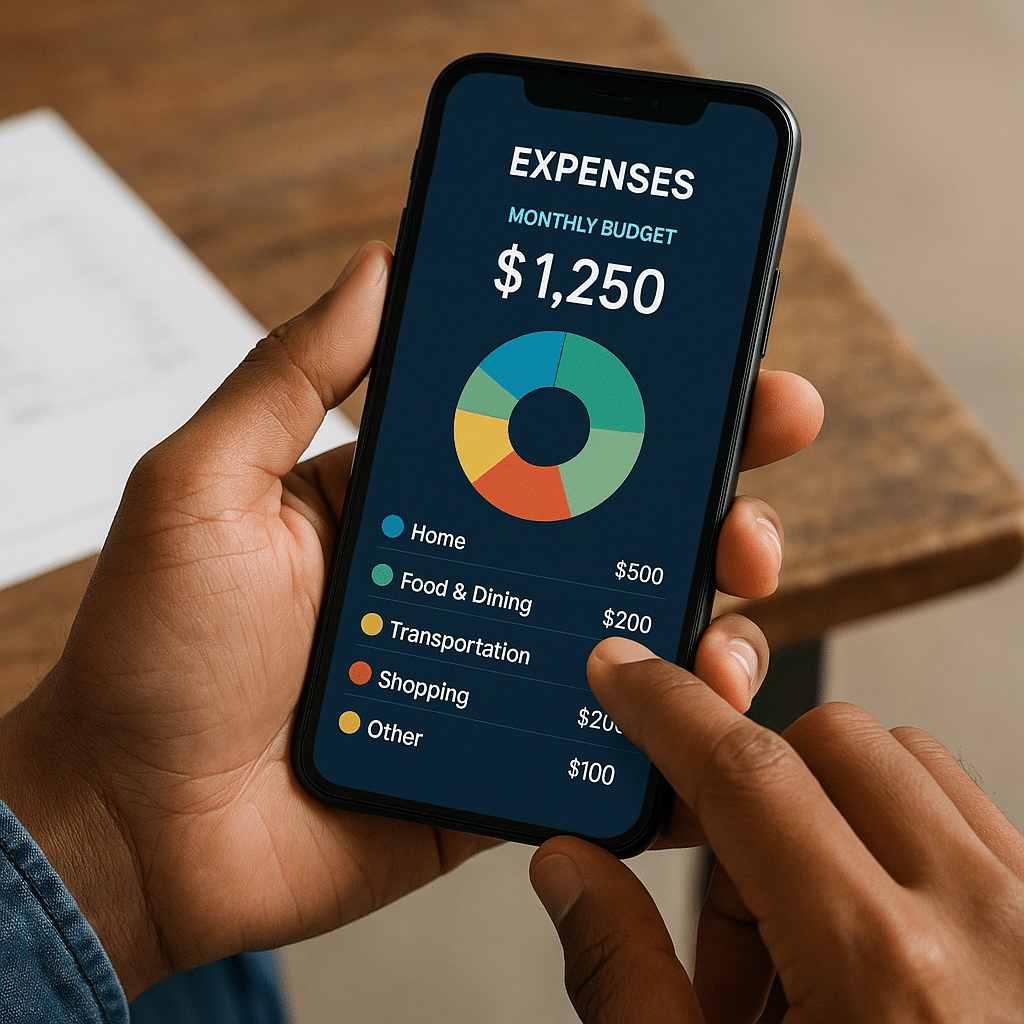

- View your income and expenses by category

- Establish monthly budgets

- Knowing how much you can spend today without affecting tomorrow

- Identify financial habits that are harming you

- Finally feeling in control

And the best part: all from your phone. With a user-friendly interface. Hassle-free.

Monefy: control at your fingertips

Monefy is an app that shines for its powerful simplicity.

You open it. You write down your spending. And that's it. It's that easy.

You don't need to create a bank account. You don't need to link cards. Just open the app and start recording your spending:

A coffee. A taxi. The supermarket. Dinner.

Everything is saved in a graph that updates automatically.

What I liked most? The visual way it shows your financial life.

Colors. Categories. Icons. All clear.

At the end of the day you know exactly where your money went.

And at the end of the month, you can see what you could improve on.

Ideal for those who love simplicity, but do not open more efficiency. Apps that transform your pocket.

Money Manager: Depth and Organization

If you want something more robust, Money Manager It is an app that looks like it came from a bank... but without the hassle of a bank statement.

You can link your accounts. Add income. Schedule fixed expenses. Create savings goals.

Everything is with security, clarity and a very well organized interface.

A cool feature: you can split expenses between fixed and variable categories.

This way you know what you can't avoid (rent, utilities) and what you can adjust (food, entertainment, transportation).

And yes, you can also add photos of receipts, export reports, or track them by week.

It's like having a personal advisor... but free and in your pocket.

Which one to choose?

It depends on your style.

- If you are looking for agility, without complications or registration: Monefy.

- If you prefer depth, detail and full tracking: Money Manager.

Both are excellent. Both work. The most important thing is that you start.

What changes when you see your money clearly

It's not just a question of savings. It's a question of well-being.

When you know exactly how much comes in, how much goes out, and how you use your money, you feel freer.

You're encouraged to plan. To say yes when you used to say no.

To save without feeling limited. To spend without guilt.

And that's reflected in your life. In your decisions. In your peace of mind.

Simple habits you can start today

You don't need major transformations. Start like this:

- Write down each expense for 7 days.

- Set a flexible daily spending limit.

- Set a savings goal for something you really want.

- Use your app's graph to detect overshoots.

- Delete a subscription you don't use.

- Set aside one day a week to review your movements.

Little by little, you are creating a new mentality.

And that is more valuable than any magic formula.

Stress-Free Personal Finance

Forget the idea that keeping track of your accounts is boring or complicated.

With apps like Monefy and Money Manager, it can even be fun.

You know yourself better. You make better decisions.

And you do it with zero anxiety.

Because in the end, money is just a tool.

The power is in how you use it.

And when you're in control, nothing stops you. Apps that transform your wallet.

Apps that transform your pocket

Conclusion: Your next financial level starts here

We're in the moment. And there are no excuses for not understanding your money.

Today, with just your cell phone and a few minutes a day, you can completely transform your relationship with your finances.

You can escape the chaos. Escape the "I don't know where it went."

And enter a state of consciousness, calm and determination.

Monefy and Money Manager are more than just apps.

They are the first step toward a life with more clarity, more order, and more freedom.

Because when you decide how to spend, you also decide how to live.

Download Here:

- Monefy:

- Money Manager: